Tracing the Flow: Wire Transfer Regulations in Nigeria

- Elizabeth Travis

- Aug 4, 2025

- 5 min read

Wire transfers remain a vital conduit for both legitimate global commerce and illicit finance. In jurisdictions with complex financial ecosystems and endemic challenges such as corruption and fraud, the regulation of these transfers is essential for safeguarding financial integrity. In Nigeria, wire transfers are not merely a technical issue of payment compliance; they sit at the nexus of transparency, state capacity, and global trust. While the country has made significant legislative and strategic strides, implementation and enforcement remain weak links in an otherwise improving regulatory chain.

Nigeria’s Wire Transfer Regulation Controls: A Regulatory Overview

Nigeria’s wire transfer regime is guided by the Money Laundering (Prevention and Prohibition) Act 202 and the Central Bank of Nigeria (CBN) AML/CFT Regulations 2022. These legal instruments implement Financial Action Task Force (FATF) Recommendation 16, often referred to as the Travel Rule, which mandates the inclusion of originator and beneficiary details in all wire transfers.

Specifically, Nigerian law requires all cross-border wire transfers exceeding US$10,000 to be reported within seven days to the Nigerian Financial Intelligence Unit (NFIU), the CBN, and the Securities &Exchange Commission (SEC). This reporting threshold is designed to improve transparency and enable the tracing of suspicious flows by law enforcement authorities.

The FATF has rated Nigeria as 'Largely Compliant' with its wire transfer recommendation. However, compliance with broader supervisory and transparency measures, particularly in relation to Designated Non-Financial Businesses and Professions (DNFBPs) and beneficial ownership, lags behind.

Persistent Challenges: Enforcement & Informality

Despite regulatory advances, Nigeria’s enforcement mechanisms remain inadequate. According to Transparency International, law enforcement within Nigeria’s anti-corruption architecture is marked by infighting, overlapping responsibilities, and inter-agency rivalry. This fragmented approach hinders the coordination necessary for pursuing complex financial crime investigations.

Supervisory weaknesses are compounded by the technological limitations of smaller banks and microfinance institutions. Many lack real-time transaction monitoring tools, especially outside urban centres. Meanwhile, Nigeria’s vast informal economy, coupled with the unregulated use of hawala networks and cash couriers, introduces further opacity into cross-border transactions.

The persistence of politically exposed persons (PEPs) avoiding scrutiny, even when red flags are triggered, illustrates the systemic weaknesses in enforcement. Cases such as the Malabu oil block scandal and the US$100 million bribery scheme involving Nigeria’s former Petroleum Minister highlight how state-linked corruption has been facilitated through global banking channels.

FATF Greylisting as a Catalyst for Reform

Nigeria’s placement on the FATF grey list in February 2023 marked a significant turning point. The greylisting prompted a national action plan to address AML/CFT deficiencies, pushing Nigeria to demonstrate measurable progress. As of 2025, Nigeria has achieved ‘Compliant’ or ‘Largely Compliant’ ratings for 37 of the 40 FATF Recommendations, with progress endorsed in the FATF’s fifth follow-up report.

Reforms include a new beneficial ownership registry launched in July 2023 and updated Person of Significant Control regulations. However, gaps persist. Most trusts are not obliged to maintain beneficial ownership information, and implementation of asset recovery and mutual legal assistance mechanisms remains underdeveloped.

Fintech & the Technological Shift

Nigeria’s dynamic fintech sector is beginning to reshape compliance standards. Innovations such as real-time transaction monitoring, biometric KYC, and mobile-based financial inclusion initiatives are creating new oversight opportunities. Yet, regulation of fintechs outside Lagos and Abuja remains inconsistent, creating geographic disparities in compliance standards.

Furthermore, the cryptocurrency sector while offering financial innovation has been identified as a significant risk for money laundering. As noted in the Transparency International report, Nigeria is one of the leading adopters of crypto in Africa, with weak enforcement allowing for cross-border movement of virtual assets without sufficient AML scrutiny.

Correspondent Banking & the UK Connection

For UK payment service providers (PSPs), engagement with Nigerian financial institutions requires heightened vigilance. The UK Financial Conduct Authority (FCA) mandates enhanced due diligence for correspondent banking relationships involving greylisted jurisdictions. This includes assessing AML controls, regulatory standing, and the ownership structure of Nigerian counterparts.

The reputational risks are not theoretical. The UK's Serious Fraud Office (SFO) and National Crime Agency (NCA) have investigated multiple transactions linked to Nigerian corruption cases routed through British financial institutions. UK PSPs are thus under pressure to exit relationships that cannot demonstrate sufficient risk mitigation.

Comparative Outlook: Nigeria vs the UK

While both Nigeria and the United Kingdom align with the FATF Recommendation 16 on wire transfers, the depth of implementation and operational detail diverges significantly. The UK’s regulatory framework which is mature, centralised, and technologically advanced enables more rigorous enforcement of the so-called Travel Rule. Nigeria, by contrast, is still in the process of standardising how financial institutions verify and transmit required information, particularly in the context of cross-border payments involving smaller institutions and informal value transfer systems.

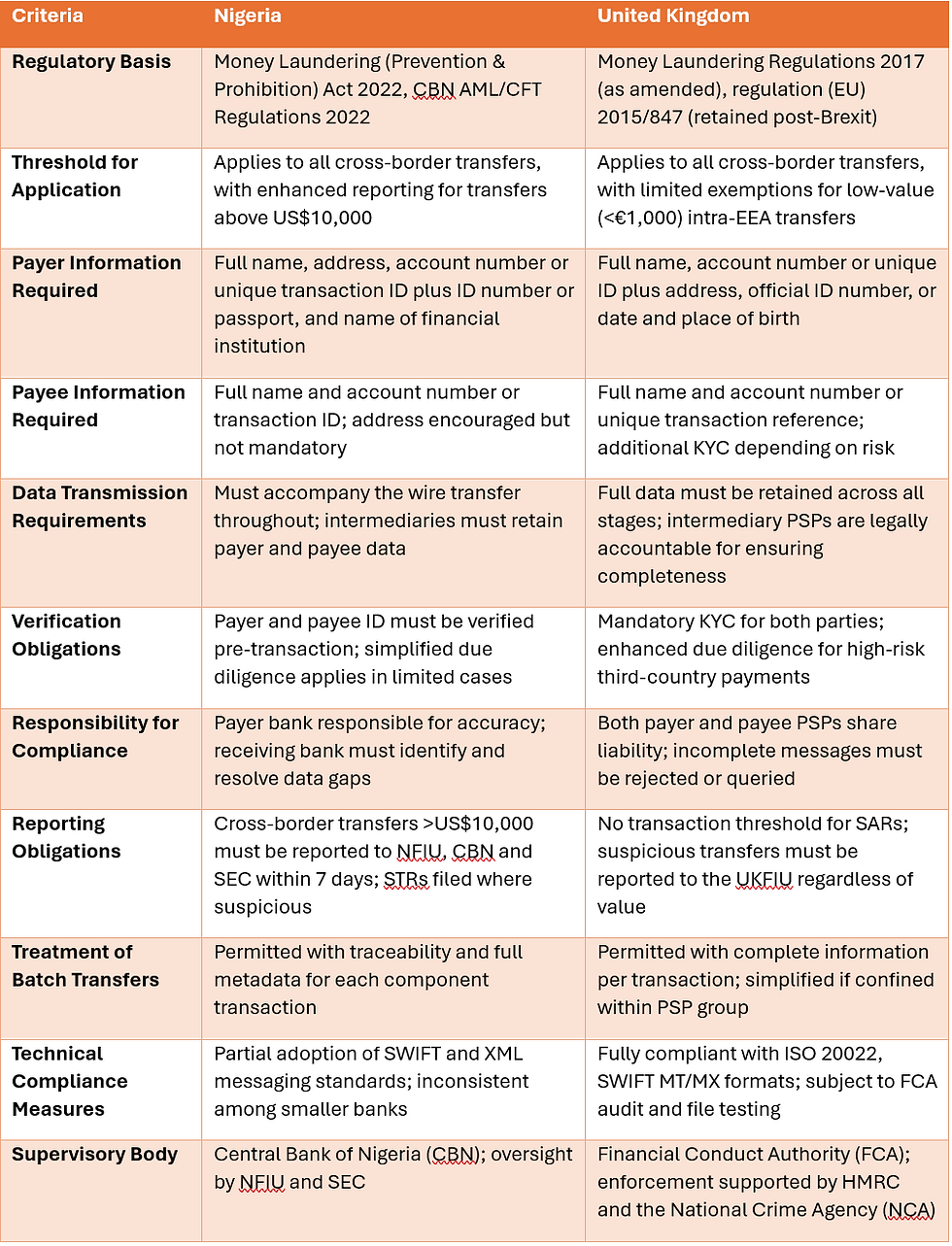

To assist compliance professionals navigating these contrasts, the following table outlines in detail what information must accompany a cross-border wire transfer in each jurisdiction. It highlights differences in regulatory foundation, data fields, verification obligations, and supervisory enforcement:

This level of detail matters greatly when structuring correspondent banking relationships, conducting due diligence, or assessing the quality of incoming wire data. The UK expects full compliance and imposes legal liability on PSPs for processing payments with missing or incorrect originator and beneficiary information. Nigeria, although aligned on paper, suffers from gaps in implementation, particularly in rural and lower-tier banking institutions.

For UK PSPs, understanding these discrepancies is vital. Where Nigerian respondents fall short of transmitting full FATF-compliant data, UK institutions must be prepared to either remediate collaboratively or terminate the relationship in line with the FCA’s expectations for risk mitigation.

Sustaining Progress & Global Cooperation

As Nigeria targets removal from the FATF grey list by mid-2025, the challenge shifts from policy drafting to operational effectiveness. Success will depend on continued inter-agency coordination, capacity-building for the NFIU, and proactive enforcement against PEPs and financial enablers.

For UK PSPs, continued engagement with Nigerian institutions must be rooted in risk-based approaches and supported by clear contractual terms for data sharing and remediation. Sustained dialogue between regulators, law enforcement, and the private sector is also vital for confronting shared risks, especially in the cryptocurrency and real estate sectors.

Conclusion: From Compliance to Credibility

Nigeria’s evolving wire transfer regulation signals a genuine attempt to modernise financial oversight and disrupt illicit flows. Yet, the journey from formal compliance to functional credibility is long and fraught with institutional inertia and geopolitical complexity.

UK PSPs and global financial institutions must support and scrutinise these reforms in equal measure. Global financial integrity is not secured through laws alone, but through transparent enforcement, cross-border cooperation, and a collective intolerance for regulatory arbitrage.

The international community must continue to invest in Nigeria’s capacity to fight financial crime and not just for compliance, but for development, trust, and sustainable economic participation in the global system.

Doing Business with Nigeria? Are You Confident Your Wire Transfer Controls Are Up to Standard?

Explore OpusDatum’s Knowledge Hub for expert insights into wire transfer regulations, payment transparency and regulatory expectations for cross-border payments.

Download our flagship white papers and when you’re ready to automate and verify with confidence, WireCheck is built to trace, screen and secure every transaction.

Visit the Knowledge Hub, read the papers, and put WireCheck to work.